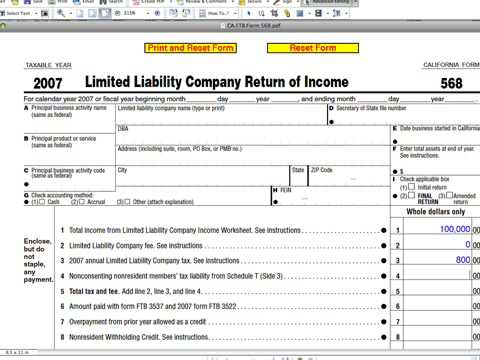

Hi, this is Bob Tooms again and I just wanted to show you what I call the California LLC tax trick. Now, although this is specific to California, I want to show it to everybody because every state really has its own little tricks. And if you can gain insight into what one state does typically, you can get an insight into what your state is likely to do. Besides, if you live in California, I really want you to see this because it's very important. What we're looking at here is the 2007 limited liability company return of income form 568. Let's just say that you've made a hundred thousand dollars for this tax year, okay? That's terrific. Now, what it comes down to for this particular trick is lines two and three: the limited liability company fee (see instructions) and the limited liability company tax (see instructions). Okay, so let's go to the instructions. Here's what this is all about. I think everybody knows that if you run an LLC in California, you owe $800 to the state, regardless of whether you've made any money or not. Now, if you're just looking at the form, if it's your first time filling this out, you're gonna see "limited liability company fee." Well, that sounds like that $800 thing that you've heard about because the $800 is a flat amount that you have to pay, regardless of whether there's any income or not. And then down here, "limited liability company tax." Well, that sounds like an amount that would be based on your income because every other tax you've ever seen in your life is based on the amount that you've made, or that your company's made, or whoever has made it. It's a graduated tax. If you made this much, you...

Award-winning PDF software

Llc k 1 Form: What You Should Know

Fully filling out the 1099-MISC form is required if it is your first time doing so. Form 1099-MISC is usually not filed online or by fax and is only filed in person. Form 1099-MISC requires two parties to have an active, current, open account. Please note: The 2025 form 1099-MISC appears to be outdated, and it has been made to include information about 1099. If you are using the website for an independent contractor, it is important that every participant complete an online tax form. Please remember, this is one of three forms of payment. Please, follow these steps to take so. Please note that this information is intended to be for informational purposes only. Individuals or businesses who should receive a Form 1099-MISC should contact the IRS for specific instructions and/or instructions regarding any tax issues, including tax forms that may apply to them, Please read the full IRS Form W-2 requirements for payment of Federal Income Taxes. See our website for IRS publication on filing Federal Income Tax forms. The form is in PDF (.pdf) and requires Adobe Reader to open.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 1065, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 1065 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 1065 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 1065 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Llc k 1