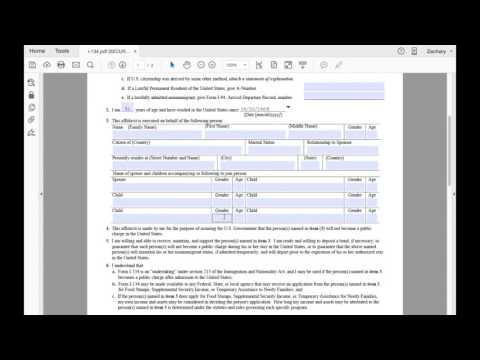

Hello and welcome to the I-134 affidavit of support form for the joint sponsor. What is the purpose of the affidavit of support form? This form is to show the USCIS that the visa applicants have sponsorship and will not become public charges while in the United States. In the fiance visa petition, we will need an affidavit of support from the sponsor. In some cases, if the petitioner does not meet poverty guidelines, we are also going to need additional support from a joint sponsor. These forms are relatively easy and shouldn't take you guys too long. Let's get started. Okay, we're gonna go down to our browser. We're gonna go to USCIS.gov. Okay, we're gonna go to the forms link on the left-hand side. Then we're gonna go ahead and look for the search bar down below and we're gonna type in I-134. Okay, click go. And then we're gonna click the PDF link here and it, we are going to download the PDF onto our desktop. Okay, save it and let's get rid of that internet browser. Now, the first thing we're going to do is open the PDF, and we're going to adjust the screen size. So let's get rid of that right-hand sidebar, adjusted to 100%, and then we're gonna make this PDF fullscreen. Okay, now this is for the joint sponsor. So if you didn't meet poverty guidelines and you're the petitioner, you're gonna need someone like your dad or maybe a friend to help you out. And this is for the joint sponsor. Okay, I, Ernest Rado, so his father, residing at 5:07 3rd Street, and then again in the city of Dearborn, Washington, with the zip code [insert zip code], we're gonna do the country United States. Okay, then certify under penalty...

Award-winning PDF software

What does a k 1 look like Form: What You Should Know

Sep 6, 2025 — Schedule K-1 is due by Oct 6, 2022, for your return. Schedule K-1 can be filed on an actual paper return as long as the information provided is accurate. Your partnership might do these things to help you keep track of everything. IRS Schedule K-1: Partnerships Sep 28, 2025 — Schedule K-1 is due September 28, 2022, for your return. Schedule K-1 can be filed on an actual paper return as long as the information provided is accurate. Partnerships are organized so that they can pay their shares from different types of corporate entities. IRS Schedule K-1: S corporations Jan 21, 2025 — If your plan is an S corporation, your Schedule K-1 is due March 1, 2023. Schedule K-1 is only used if each shareholder pays its individual taxes on time by using Schedule SE for federal income tax purposes, and Schedule SE income tax for state income tax purposes. Schedule K-1: Partnerships. For Partnerships. You can also fill out Schedule K-1 as part of your Partnership Tax Return, Form 1065, (Form 1065F), to report your earnings What are the basic rules on Schedule K-1? Schedule K-1 Tax Form: Who Gets the Information? How to Fill Out Schedule K-1: The Basic Rules For Partnerships Sep 28, 2025 — Schedule K-1 is due September 28, 2022, for your return. Schedule K-1 can be filed on an actual paper return as long as the information provided is accurate. Your partnership might do these things to help you keep track of everything. Schedule K-1 Tax Form for Partnerships: For Partnerships. Schedule K-1 for Partnerships: Who Gets the Information? You should fill out Schedule K-1 on an actual paper return as long as you have all the information from a partnership return, as outlined in the IRS instructions. You will need the partnership information, such as the business entity name, the name of the employee(s) you are planning to pay federal income tax to, the name, address and payroll business number of the business entity, the business entity's Social Security Number, the date you joined, the date your spouse joined, and the partnership's type.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 1065, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 1065 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 1065 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 1065 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What does a k 1 look like